If you run a business in Birmingham — whether you’re based in Digbeth, Selly Oak, the Jewellery Quarter or anywhere else — you already know how many costs you need to juggle. One that regularly trips people up is prepaid insurance. It feels simple when you pay it, but recording it properly in your accounts is where things get a little confusing.

What Is Prepaid Insurance?

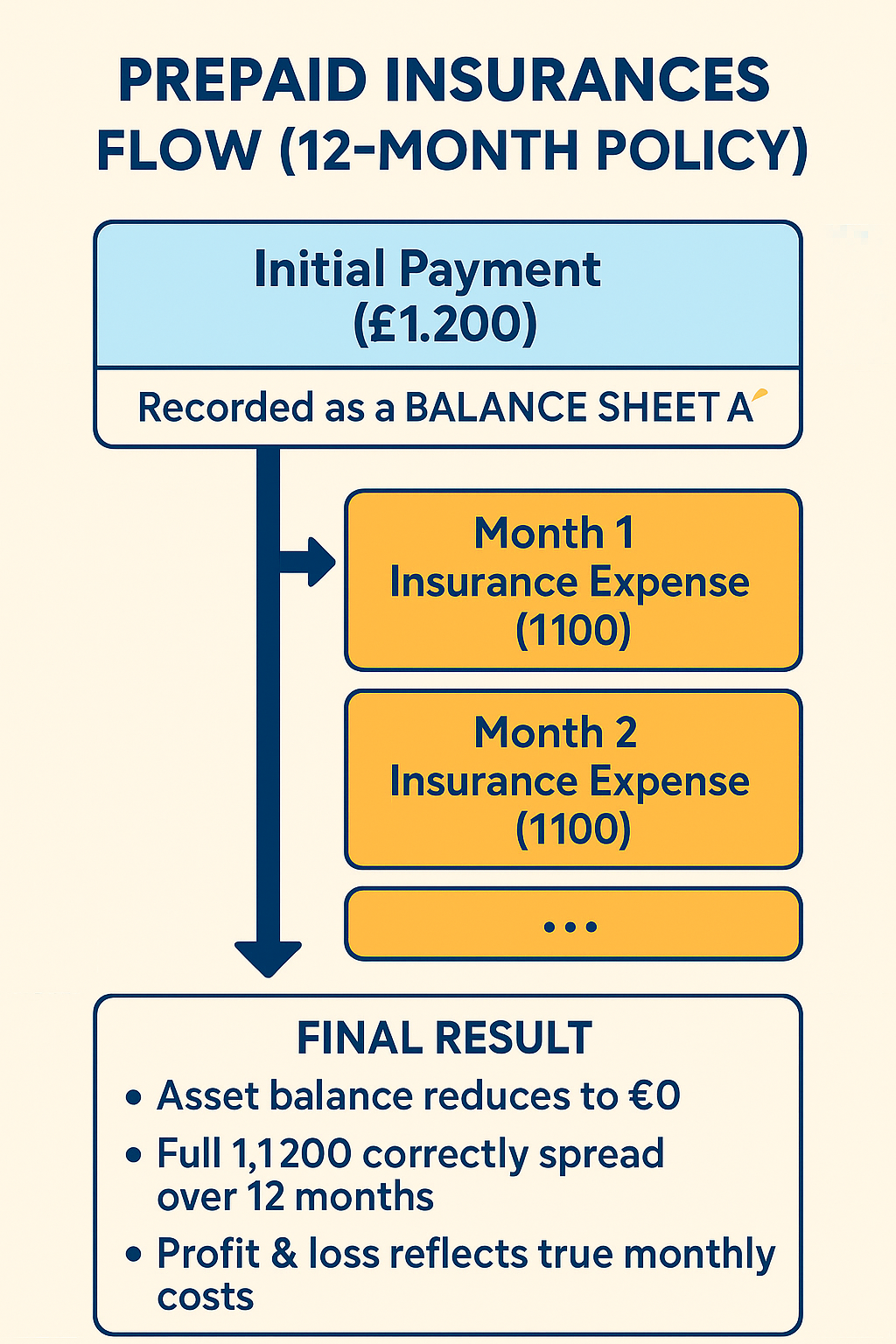

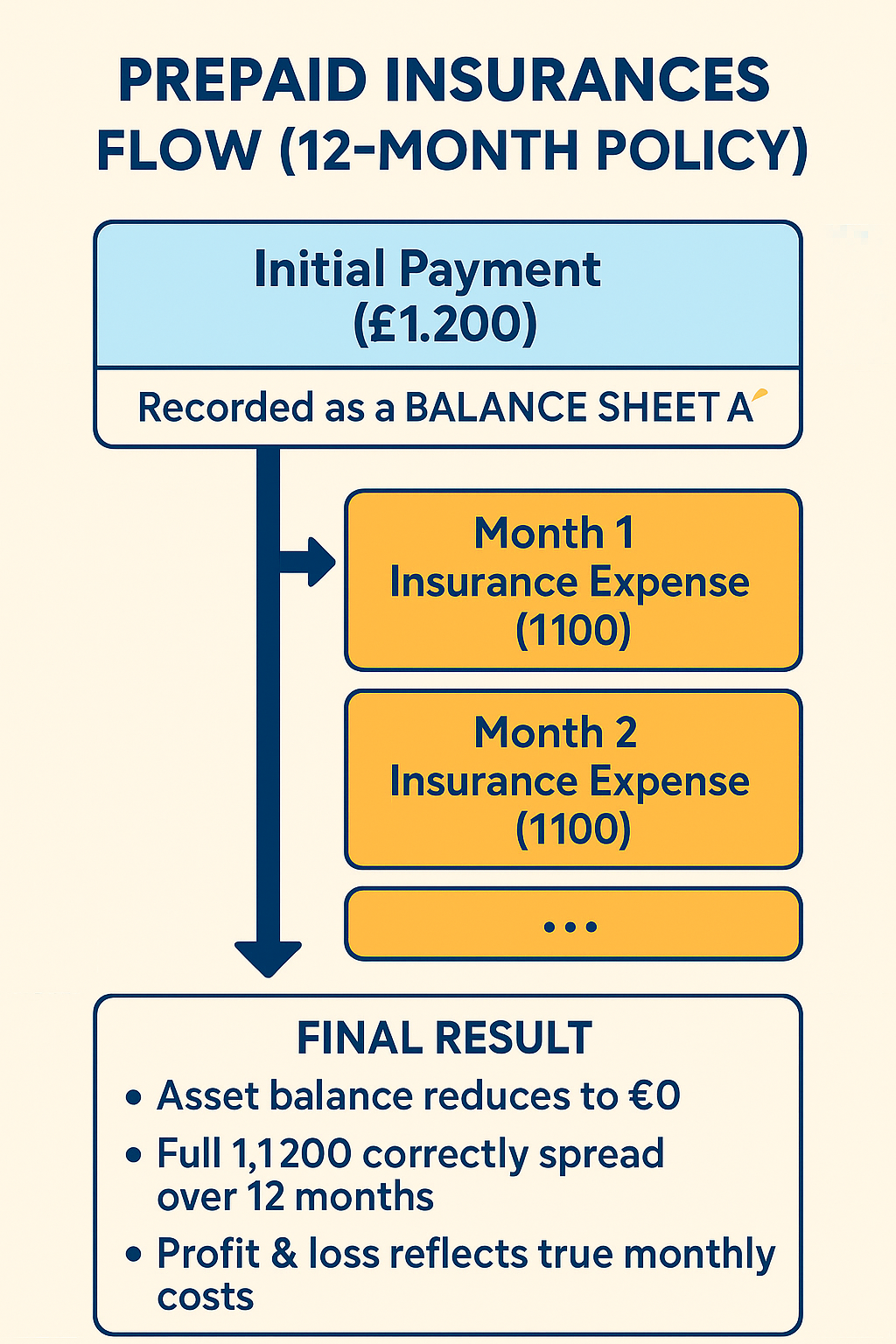

Prepaid insurance is when you pay for your policy before you actually benefit from it. So if you pay £1,200 today for a 12-month policy, you haven’t used that £1,200 yet. That means it isn’t an immediate expense. In accounting terms, it starts life as an asset.

Why This Matters for Birmingham Businesses

Whether you run a café in Moseley, a roofing business in Erdington, a salon in Kings Heath or an online store in Harborne, handling prepaid insurance correctly makes a big difference. It helps you keep your accounts accurate, avoid end-of-year clean-ups, and understand your real monthly performance. Many business owners don’t realise how much this affects things like budgeting, loan applications and long-term planning. For example, clear prepaid insurance records can improve:

- the accuracy of your monthly profit reports

- your cash flow predictions

- how “funding ready” your business looks to lenders

How to Record Prepaid Insurance

When you pay your insurance upfront, you should record the full amount as a prepaid insurance asset. Using the earlier example, if you pay £1,200 for a 12-month policy, the whole £1,200 goes onto your balance sheet as an asset rather than straight into expenses.

Each month, you then move a portion from the prepaid asset to your insurance expense. In this case, that would be £100 per month. This reflects the fact that you’re gradually using the insurance over time, and it keeps your profit-and-loss statement accurate and easier to interpret.

You repeat this process until the prepaid balance eventually reaches zero when the policy ends.

Common Mistakes Birmingham Businesses Make

A lot of business owners across Birmingham accidentally record the full insurance payment as an expense straight away, which makes their monthly profit look worse than it actually is. Others forget to adjust the prepaid balance each month, leaving their accounts messy and unclear when they’re trying to apply for funding or prepare for year-end. Avoiding these simple mistakes keeps your books cleaner and gives you a more realistic picture of how your business is performing throughout the year.

How Prepaid Insurance Helps You Plan Better

When prepaid insurance is recorded properly, it smooths out your expenses and makes cash flow planning much more predictable. Instead of seeing a large one-off hit in your accounts, you get steady, manageable costs spread over the year. This helps Birmingham entrepreneurs plan seasonal fluctuations, prepare for quieter trading periods, and make smarter decisions about hiring, investing or taking on new clients.

A Simple Formula to Remember

Prepaid insurance is a future cost, so you treat it as an asset now and expense it gradually. It’s straightforward once you’ve done it once, and it makes your accounts far cleaner and easier to understand.

Final Thoughts for Birmingham Entrepreneurs

Correctly recording prepaid insurance might not be the most exciting part of running a business, but it’s one of those small accounting habits that pays off. With more accurate monthly figures, fewer surprises at year-end, and a clearer picture of your financial health, you give your Birmingham business a stronger foundation to grow on.